E-commerce platforms are on the verge of a new era of transparency, requiring brands to up their game on electronics quality and returns. Consumers have had access to peer consumer reviews on e-commerce sites like Amazon for years. However, consumers still spend significant time reading reviews to determine whether poor ratings equate to poor electronic device quality. The star ratings themselves have a significant impact on sales, as Andre Neumann-Loreck, founder and managing partner of On Tap Consulting, shared in 2020, “The difference between five stars and four stars on Amazon can be 50% of sales numbers”.

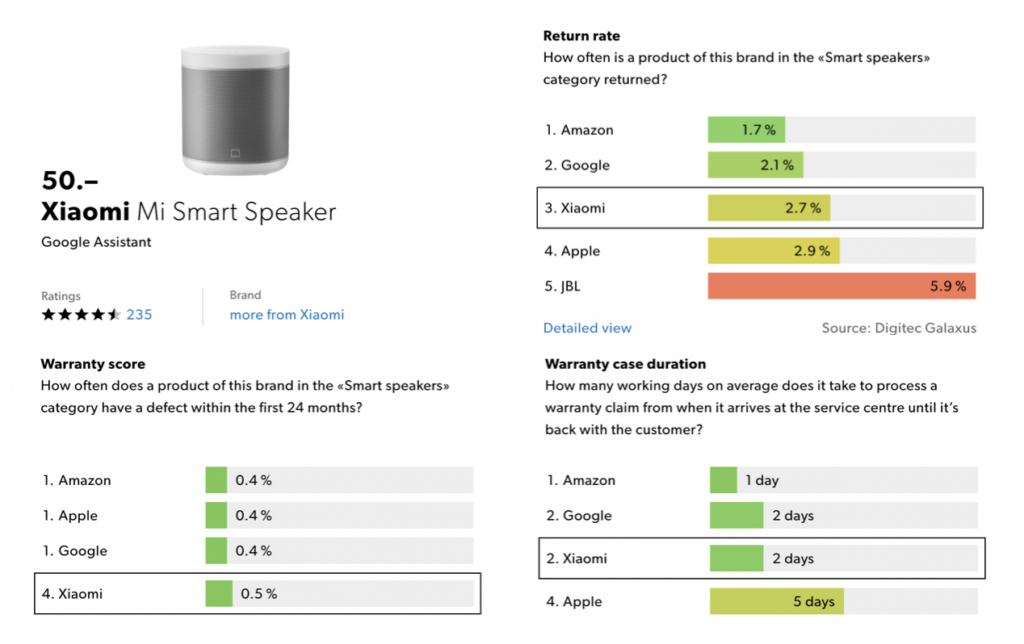

Recent changes are causing a shift towards more transparent information. This could have ripple effects through electronics brands’ supply chains, particularly in competitive categories. For example, Digitec Galaxus, a Swiss e-commerce platform, started putting return and warranty rates for all of the items it sells in January of this year. For brands in competitive categories, Galaxus and Digitec will show their statistics and those of their competitors. Similarly, Amazon recently started rolling out “frequently returned” labels for some items. Returns are a huge cost for retailers – the National Retail Foundation reports that 16.5% of online retail purchases in 2022 were returned. The intended effect of these transparency initiatives is likely to drive consumers away from low-quality products that cost retailers money in reverse logistics costs and towards higher-quality ones.

Example of Galaxus return and warranty data for a Xiaomi smart speaker — Galaxus provides this type of information for all of their products with enough sales volume.

Product quality data has become increasingly front and center for customers during the buying process. Brands are now forced to re-think whether their return rates are acceptable when clear alternatives are available. Even brands with excellent scores will likely begin to feel pressure from competitors. It’s reasonable to assume these brands already invest in core best practices for low return rates. Best practices likely include keeping product design and quality in-house, having rigorous reliability qualifications and ongoing reliability tests, and investing in production oversight. Collecting data on your products and manufacturing processes is no longer enough since your competitors are likely doing the same. Turning that data into intellectual property is the next frontier to staying ahead.

Data becomes intellectual property when it can be uniquely leveraged to produce the best business outcomes, such as unique product performance, lower return rates, and strong margins. This means more than just collecting data. It means turning that data into actionable insights to improve product quality, the rate of escapes that result in returns, and the efficiency of the manufacturing process. One priority for these brands will be to invest in advanced analytics tools to identify new patterns and insights in their data. Another is to move from one-time insights to real-time oversight – with alarms set up when process capability shifts. As transparency becomes the norm, brands that make investments here will be able to drive down the costs of escapes and win more top-line revenue from their competitors.

In the end, the message is clear: transparency is coming. Brands that want to maintain or grow their sales must invest in the infrastructure and tools needed to turn their data into intellectual property. By doing so, they’ll be able to outpace their competitors and provide customers with the electronics quality and reliability they demand.

Related Topics