Consumer electronics companies are among those who are taking the hardest look at moving pieces of their manufacturing supply chains out of China in response to the escalation of tariffs between the United States and China. Smartphones, laptops, smart speakers, routers, and countless home IOT products are often in fierce competition where price is a factor and a 25% price hike to cover a tariff is too much to swallow.

In a recent survey by the American Chamber of Commerce in China, 40% of respondents said they had either moved or were considering moving supply chains outside of China, with 25% identifying Southeast Asia as the target destination. Apple, Google, and Nintendo are reportedly among them.

To avoid the tariffs, companies need to ensure that their product assembly undergoes a substantial transformation outside of China. Those who are considering the move are mostly looking at opportunities to move the final stage of assembly: where multiple larger sub-assemblies come together to form the final product. While this may sound like a small modification in an already complex system, this is a huge challenge on its own. Here are the seven problems that consumer electronics brands will need to solve to move their final assembly out of China.

- Move development or just mass production?

Every product life cycle includes a development phase and a mass production phase – each requiring different skill sets.

At first glance, it might seem easier to just move a handful of production lines after development has been completed with an experienced team in China. This is already commonplace to adapt to Brazil’s steep 10% to 35% tariffs: most brands that sell in the Brazil market build their final assemblies on a few assembly lines located in Brazil. But there’s hidden complexity. We’re not just talking about moving a handful of lines, we’re talking about 30% or even 60% of the total number of lines needed to meet U.S. demand for a smartphone from a top manufacturer. That’s a significant undertaking that will result in needing nearly a full team in both locations and a way to reliably transfer knowledge – not to mention increased complexity in keeping the supply chain responsive as demand grows or falls for a specific product.

Moving development and production enables a consolidation of resources to one location — enabling the brand to focus on bringing up a new manufacturing partner and building only one local team, wherever that may be. The main drawback is the loss of tribal knowledge, trusted partnerships, and a variety of other issues that are covered below.

2. What tribal knowledge with existing factory partners is lost?

How do you build a new product from scratch? Much of what makes the system work today really isn’t written down. Even the very names of the process used feels like a code. In order to learn how to build millions of things from scratch, you need to apprentice in the field. I spent nearly six years at Apple learning this subtle art from teams of engineers and suppliers who had been doing it and excelling at it for more than a decade. While most large brands will make a show of seeking new RFPs (Request for Proposals) every year from new manufacturing partners, they almost always pick the same favorites again and again, because “Foxconn sure can ramp” or “Pegatron really excels at quality” or “Transtek has the best service”. The tribal knowledge these partners have accrued from doing laptop after laptop, and smartphone after smartphone can be taught by a few senior team members that cover the core functional areas, but only over the course of a product cycle or even two. Even if you transfer to a Foxconn facility in another location, you will work with a different local team with different prior experience. Your team in Hungary may be some of the best in the world at making espresso makers, but that may not translate to smooth development of new smartphones.

3. What about the China team you already have?

Many companies who manufacture in China have hired large local teams of manufacturing, quality, and toolings engineers as well as logistics and operations teams. While many of these team members will still be needed in China to support the large upstream supply chains that will remain there, if final assembly moves elsewhere, some of them won’t. Will companies lay off these highly skilled workers?

4. How do you retool for the new language skills required?

Chinese language skills coupled with engineering competency is prized and sought after by leading consumer electronics brands. But when assembly moves to Thailand, Vietnam, Indonesia, or the Philippines, new language skills will be needed. Most manufacturers provide bilingual teams to support their customers in English, but nothing beats native speaking proficiency to overcome the inevitable issues that arise during development and early production.

5. Where will large numbers of operators be sourced?

A standard assembly line is 110 meters long and can require as many as 180 people, called operators, sitting shoulder to shoulder. A complex product like a smart phone might have 200 or even 300 people who touch it during the assembly process, and a high volume product might need twenty, thirty, or even sixty lines. The immediate demand for thousands of operators in far flung locales that haven’t had that kind of demand in the past will be a challenge. Even if those workers can be gathered, they will likely need physical infrastructure: places to sleep, to eat, and to live meaningful lives. Products with smaller production volumes that only need 100s of operators will have an easier time.

6. How do you account for longer supply chains?

One of the cardinal rules of supply chains is to make them as short as possible. Adding an additional step, or picking up and moving a step outside of China, adds at least two weeks in transit to the overall supply chain length as well as the cost of shipping. Two weeks may seem insignificant, but for a product making 100,000s each day, a two week longer supply chain is an additional 1.4M parts of lag in responsiveness to market demand or issues downstream. If you have a functional issue that starts popping up in your product’s Amazon reviews, even if you fix it immediately, you’ll have another 1.4M units that might have the issue that you’ll have to try to screen, rework, or ship anyway and hope for the best. Longer supply chains have hidden costs that add up. To counter this, companies will need to rethink and likely invest in improving their quality and inspection programs.

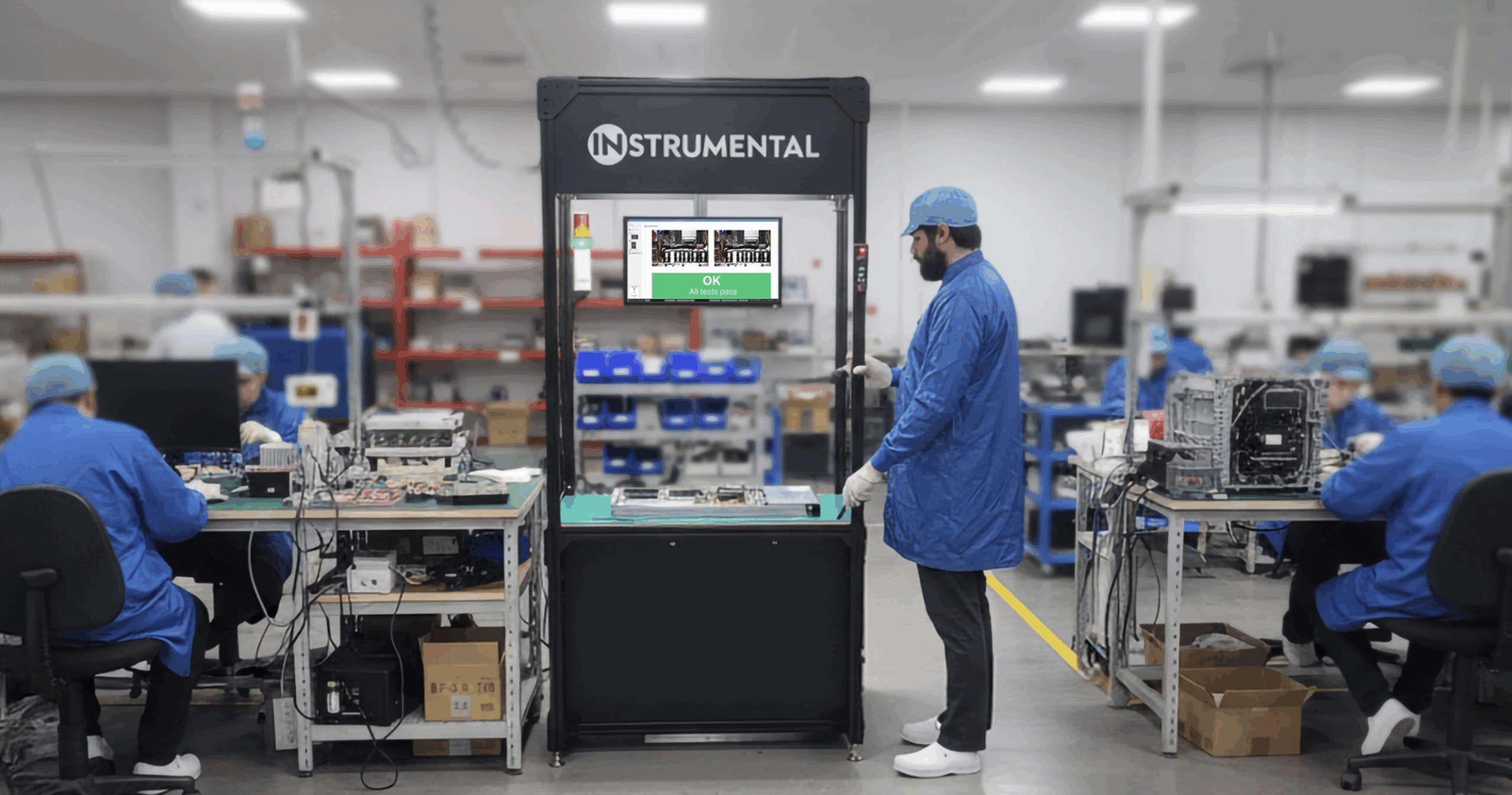

7. What about high capital equipment costs and rebuilding data pipelines?

There’s more to a factory than the assembly line and its operators. There’s a whole supporting infrastructure of inspection equipment (like measurement microscopes), specialized test equipment (like X-ray machines, CT scanners, anechoic chambers), laboratory equipment (like FTIR machines and cross-sectioning setups), and reliability equipment (drop test robots, thermal chambers) that have been accumulated over many years. To start building smartphones in a new location requires a large amount of capital equipment to even get the necessities. One thing that might be easier with a factory move out of China will be access to unfettered Internet to pipe out manufacturing data for analysis and review. Unfortunately though, factory data systems are so fractured that even if you move from one Flex factory to another, you’ll likely need to redo all of the integration required to connect your test equipment to the factory shop floor data systems.

What do these challenges mean for consumer electronics manufacturers?

At top consumer electronics brands around the world, supply chain teams are spending significant time and effort to create and execute plans to move a portion of their manufacturing outside of China. The consumer electronics world moves to the annual beat of the Christmas season and the diaspora has begun. For those who have decided to move development and production, these moves have already happened or will start soon – usually to Southeast Asia or Mexico. For those only moving production lines, preparations have likely started and lines will start coming online over the summer. Given the magnitude of these seven key challenges, there’s a high likelihood that we see the evidence of these moves in the form of more high profile delays in products released for this Christmas season. To avoid these delays, companies will be looking for any way they can to reduce other risks in these new products – likely by simplifying designs or pulling in new technologies. After this first product cycle outside of China is complete, the world of consumer electronics manufacturing will never be the same.

Related Topics