Product design and manufacturing optimization is a messy business. Glues, screws, and the ever-shrinking PCB has made it harder and harder to build something remarkable that stays remarkable for more than one lifecycle.

Not only are products getting more complex, but the process to build them at scale is getting more complicated. COVID-19 has disrupted travel and supply chains the world over – yet the pressure to launch new products has only gotten higher. In fact, the only thing higher would be consumer expectations – which demand pure perfection in exchange for mercy in their reviews.

As electronics brands compete to grow – or even retain – their existing market share, they’ll need to reimagine the way they build if they want to be first to market with a new product.

And being first in line requires being the best on the line – and it starts with manufacturing optimization.

Manufacturing Optimization is a holistic discipline that enables manufacturers to get from proto to mass production and beyond as quickly as possible, with as little waste as possible. It’s a data-driven embrace of a better way – one that leverages emerging technology built on the powerful shoulders of math.

It’s also not new. Major hardware brands have always looked to optimize their build processes, typically in the form of large one-off consulting engagements. A brand might invite an expert team in to analyze their end-to-end product development and manufacturing processes and recommend a list of opportunities to improve, to be executed over months or years following the audit.

Today, with the expansion of IoT connectivity in factories and cloud platforms that provide data access and transformation, teams are increasingly able to take optimization into their own hands, driving continuous – rather than instantaneous – optimizations at the level of individual processes, whole factories, or even across a complex supply chain.

To put it less whimsically, manufacturing optimization means using data to go faster. Faster at finding defects, faster at validating solutions, and faster at maturing products. Faster where it counts.

“Manufacturing optimization is the practice of using data to build better products, faster, with the goal of being more competitive.”

Below we’ve broken down manufacturing optimization into three components: Product design optimization, ramp and MP optimization, and supply chain optimization.

Product design optimization

Product design optimization is a focused subset of optimization which takes into account the shape, size, component assembly, desired functionality, and consumer lifestyle of a market need in order to build the most effective device possible to meet the demand.

As manufacturers look to build new products to introduce to post-COVID market, designs will need to be smarter and processes more efficient to lower costs and reduce rework that may waste limited supply resources. They must also reach for unprecedented functionality to outpace competitors in their market and establish undeniable demand for the product.

This requires that engineers analyze their product design to assess if components are too close together or difficult to place facing the same direction, if placement of functional parts are too close batteries or overhangs, if component fragility is a potential problem, etc.

A product designer must predict the needs of the manufacturer so that both market needs and the manufacturing process are achievable. Their goal is to minimize operational time and cost, eliminate needless material that add weight, reinforce weak areas that may fail or cause issues in the field, and other design-specific defects. This can include deciding between glues and screws, whether or not to hand solder, or the size of your coax cables.

Here are a few new approaches to consider:

- Find more issues in EVT builds. If you focus on getting a full catalog of issues, you’ll realize that certain design features create clusters of similar issues that might be better resolved through a broader design change.

- Operate against the entire pareto. Most product teams are just scrambling to fix the obvious issues that happen. Those are often not the most critical or nefarious. Change your mindset to find every issue as early as possible. Putting more effort here (or deploying an optimization tool to do so) will save weeks by allocating resources to solve issues more efficiently.

- Focus on traceability. Make sure you have the right data ahead of time, it will save you time later.

Ramp and production optimization

Product design optimization occurs during the EVT and DVT part of the build process. As units are produced and failures occur in PVT and approaching ramp and MP, the hunt of process-specific defects begins – and can sometimes be the most costly piece of the puzzle.

This requires product data – photographic, functional test data, and any other proprietary components be tracked with the ability to segment in order to find correlations across lines, suppliers, field engineers, etc. Most teams currently use spreadsheets or other intelligence tools to aggregate and assess these data types, though the information is often siloed or localized making it hard to work cross-functionally.

Once this product data starts streaming in, it must also be shared virtually so that teams can collaborate more effectively no matter where they are. Visual inspections and defect analytics transcend language barriers and timezones, creating a more cooperative environment from brand to CM.

Here are a few new approaches to consider:

- Test for every known issue. Modern tools beat out antiquated AOI systems by making it easy for you to set up dozens of tests, even for very infrequent issues. As an operations lead in charge of ramp, you should expect 360˚ visibility into every issue so that you can choose to manage risk

- Nail down quality differences from different suppliers. Often parts come from different suppliers and may vary in quality or fabrication, and you don’t know if that causes issues until later. By adopting a data-forward approach, you can quickly correlate downstream issues to these types of differences.

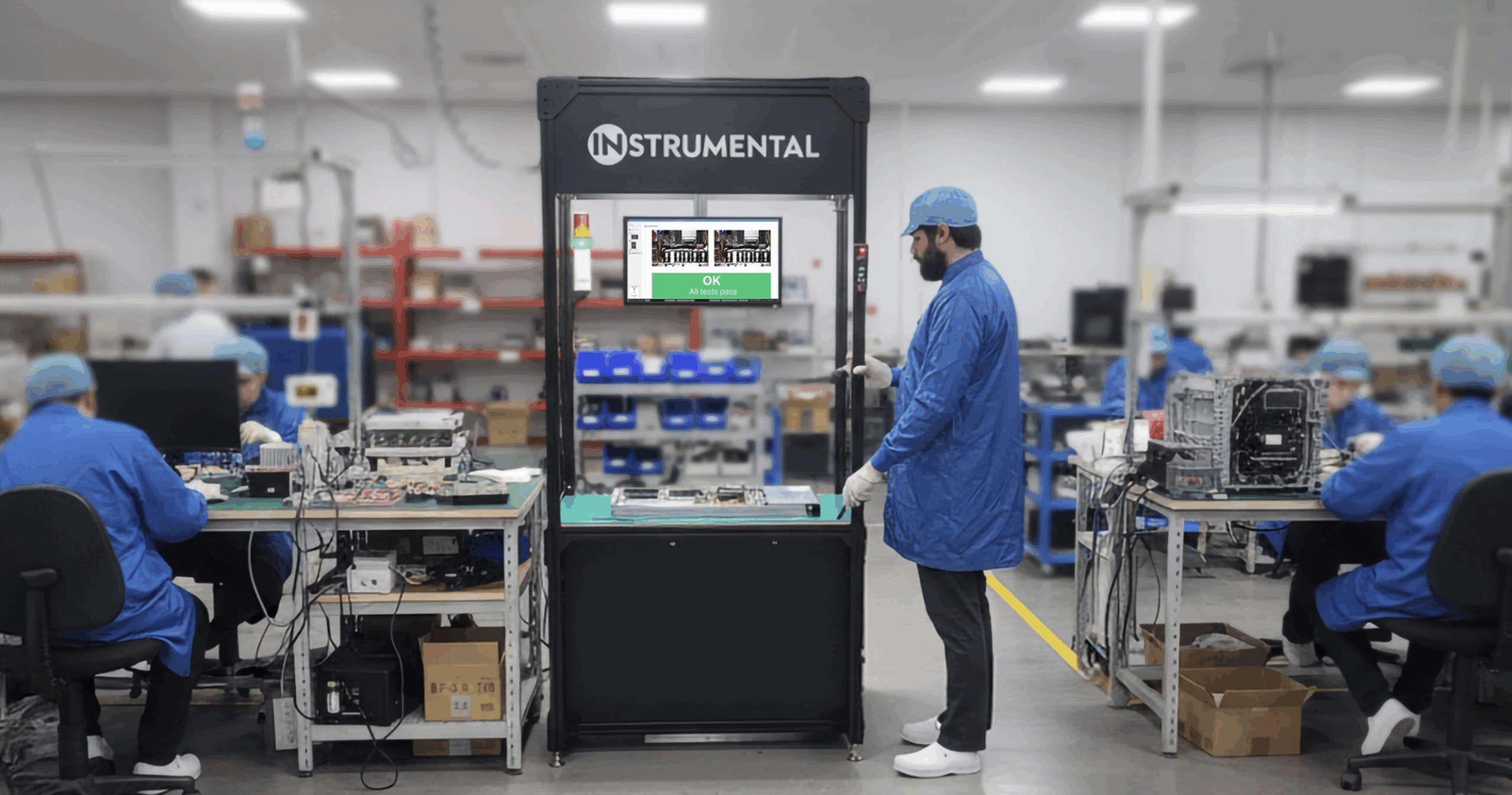

- Improve remote collaboration. Modern tools like Instrumental capture photographic data by sku and can import functional test data and measurements in order to derive correlations with failures and returns. Links for specific units or groupings of units by defect type or failure can be shared remotely to any teammate for immediate action.

- Assess variable operator performance. How are people being trained? Are shifts too long? Are procedures too difficult to teach?

- Iterate across generations. Using a new manufacturing optimization platform that can aggregate data streams across builds can eliminate common problems altogether if certain learnings can be applied.

- Stabilize the assembly line environment. Are you keeping tracking of variable setups that may be impacting performance? Different types of jigs, tools, or lighting used to perform assembly steps can cause minute issues with larger impacts downstream.

- Discover unforeseen issues unrelated to the product. Some issues happen agnostic to the inner workings of the product. Shipping and packing may come to be an issue is assemblies are too long or if too many failures occur.

Supply Chain Optimization

Supply chain optimization once could be simply defined as operating a supply chain at peak efficiency. Today, supply chain optimization has an asterisk for operating at peak efficiency and resiliency as well.

The global health crisis has really brought to the forefront how brittle the supply chains that we’ve built in the electronics industry have become. This brittleness wasn’t intentional – but it has become the downstream result of reactive processes. Socio-economic pressures like tariffs and changes in globalizations have made these supply chains longer and spread out over more geographic reasons and 2020 showed us how brittle it truly was.

As we rebuild the supply chains to accommodate a post-pandemic future, organizations will need to continue striving for the same goals but within a new context.

Organizations will still need to negotiate for discounts on volume orders, but there also needs to be a reliability and predictability with what is delivered and in what state it is delivered. They will also need to continue finding better and more competitive suppliers to drive down their own costs, but in order to ramp new suppliers they will also need to build reliability measures to coincide with any new partnership.

In order to make the supply chain more resilient, you have to be able to monitor the “health” status of your supply chain in real-time, in order to eliminate downstream consequences. Optimizing geographically (where are different parts and assemblies built relative to where they will be packaged or sold) will also be critical – as different countries will have different responses to any future resurgence of the pandemic.

Here are a few new approaches to consider:

- Operating against the entire Pareto. Focus on identifying and characterizing every issue impacting yield. This helps you figure out which issues are worth fixing, and which ones to fix first.

- Factor in customer sat. Most electronics brands think of returns / sustaining engineering separately from their supply chain costs, and find it difficult to connect the dots between how bad reviews from defects should factor into their per-unit cost of building – but they do! You need to think about the cost of field failure the same way you think of accounting for defective parts from a supplier (except in many cases the impact is orders of magnitude bigger).

- Look upstream. Most attention is focused on the final assembly line, often run by CM’s, but many defects happen before the parts ever arrive on the line. Supply chains, however, are often a complete black box when it comes to data. Technology like Instrumental allows you to collect and analyze data at upstream suppliers just as easily as in the final assembly plant. The benefits range from earlier detection of issues to better relationships with your CM/process team.

It’s a new world for electronics brands. In a world full of chaos, the last thing someone wants is to buy a product that they can’t trust. Apple will survive this economic downturn in large part because of the trust they’ve instilled in their brand. They can introduce new products substantially different annually seemingly without failure. Not only do they meet customer expectations – but they raise the bar too high for most brands to reach.

Instrumental is giving a leg up to brands looking to pull themselves up and over that bar into the future.

Related Topics